Layoffs associated with the coronavirus pandemic have hit lower-income workers much more than those at the highest end of the pay scale, but their compensation while off the job can double their typical wages.

A National Bureau of Economic Research look at employment trends over the past three months showed that two-thirds of all displaced workers are eligible for benefits that exceed their typical wages.

In some cases, the increase can be dramatic.

Unemployed janitors can collect 158% of their pay, while the typical retail worker can get 142% of what they had been earning, according to a study by NBER researchers Peter Ganong, Joseph S. Vavra and Pascal J. Noel. Each is affiliated with the University of Chicago.

Overall, they discovered that 68% of the unemployed can get benefits exceeding what they had been earning, with the median replacement rate being 134%. Those in the bottom 20% of income are eligible more than 200% of their salaries. Occupations with the highest percentage of unemployment compensation compared to salary include food service, janitors and medical assistants.

The extra benefits are the result of the CARES Act, which sought to provide a life raft for workers displaced by efforts to combat the virus. The program gives millions of workers $600 a week above what they would normally collect in unemployment insurance benefits. Workers considered essential, such as those in health care and at grocery stores, are getting their normal salaries as they have continued to work through the crisis.

While the CARES funds have helped bring financial stability to impacted households, concerns have been raised over the idea of giving workers added incentive not to return to their jobs. The CARES Act funding expires at the end of July and is unlikely to survive in its current form.

The NBER paper does not make specific recommendations but notes that policymakers could weigh altering the program so that unemployment compensation stays below 100% of previous wages. Even providing an extra $300 instead of $600 still would leave 42% of all workers above full pay, the researchers note.

"High replacement rates can provide crucial liquidity necessary for households to smooth consumption during this unprecedented period of economic dislocation," they said. However, they added that the above-100% "replacement rates" can "create distributional issues and may hamper efficient labor reallocation both now, and especially during an eventual recovery."

The authors also point out that furloughed workers in many cases lose health coverage and are providing public health benefits by staying home.

Working out the 'moral hazard'

The most recent Federal Reserve "Beige Book," which summarizes activity from the central bank's 12 districts, reported employers saying they were having a hard time getting workers to come back because they are making more on unemployment.

U.K. Finance Minister Rishi Sunak announced Wednesday his intention to wind down a similar program there that he said "can't and shouldn't go on forever." The decision to curtail unemployment benefits generated criticism that it was premature at a time when the employment crisis is far from over.

The current U.S. system "induces trade-offs between consumption smoothing and moral hazard," the NBER paper states.

The researchers conclude that providing a policy that provides compensation on a percentage basis rather than a fixed-dollar amount could be more efficient.

"Such a policy does not provide the same disproportionate benefit to the poorest unemployed, but it can achieve substantial income replacement and resulting liquidity without pushing replacement rates above 100% for many workers," they wrote.

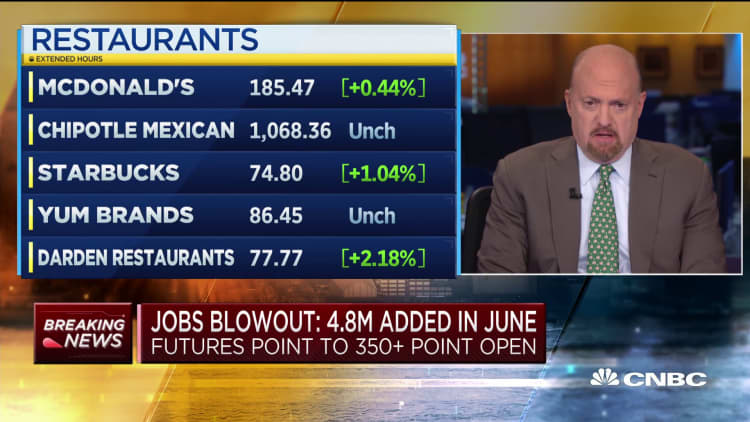

The jobs market has been staging a comeback over the past two months, with 7.5 million jobs added and the unemployment rate coming down from 14.7% to 11.1%. However, permanent layoffs have been rising, and Fed officials say more fiscal help likely will be necessary to help the economy continue to recover.

A separate NBER study showed that employment fell for 30% of those in the bottom-fifth of workers while the number was just 5% for the top quintile.

The numbers emphasize the challenge for policymakers even as the labor market makes strides from the biggest layoff cycle in U.S. history.

"We've seen a nice recovery, we've seen a bounce," said Michelle Meyer, U.S. economist at Bank of America Global Research. "But it's going to get more challenging."